Table of Contents

Introduction

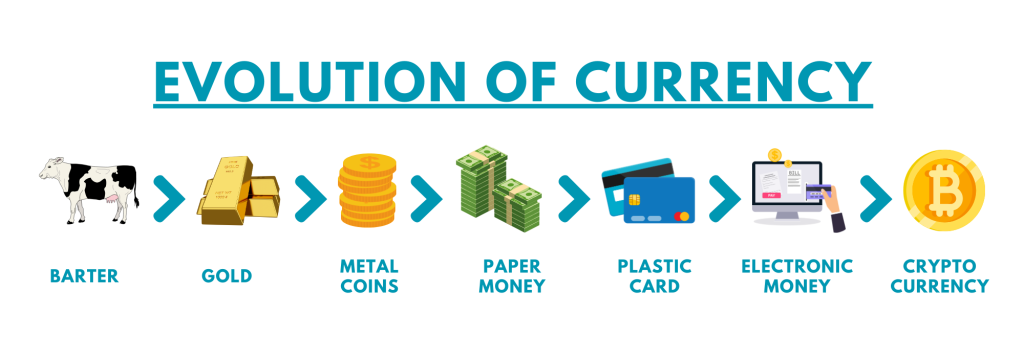

The Forex market stands as a dominant force in the financial realm. Given its immense daily transactions, it surpasses many other financial markets combined. This vastness not only signifies its current importance but also its deep historical roots. We’ve transitioned from an era of simple bartering to today’s sophisticated digital platforms. These tools, fortified by cutting-edge technology, showcase the significant transformations the Forex market has experienced over the years.

From Ancient Barter to Digital Transactions

Before the inception of modern Forex trading platforms and electronic exchanges, the roots of trading can be traced back to ancient civilizations and their necessity to exchange goods.

Ancient Trade Routes: The Silk Road and the Origin of Currency Exchange

One of the most famous ancient trade routes, The Silk Road, connected the East to the West. Merchants and traders along this route bartered goods ranging from spices and silk to precious gems. Beyond just goods, this route saw the exchange of different currencies, marking the earliest forms of currency trading.

The Transition: From Bartering to Metallic Coins

While bartering served its purpose, its inherent challenges, especially in the consistent valuation of goods, became evident. As societies progressed, a standardized medium was required. The solution materialized in the form of coins made from metals like gold and silver, setting consistent trade values across different regions.

Stabilizing Global Commerce: The Gold and Silver Standards

With the expansion of global commerce and the complexities of growing economies, a robust and stable currency system was crucial. This led to the introduction of the gold and silver standards. Under these systems, each unit of paper money was backed by a specific amount of gold or silver, ensuring trust and stability in currency values.

Adapting to Modern Times: The Introduction of Plastic Money

The world’s evolving economy necessitated a safer and more convenient method of transaction. While physical cash had its merits, it was also prone to theft, deterioration, and loss. Furthermore, with technological breakthroughs and the rise of global businesses, efficient and expansive payment methods like credit and debit cards came into play.

The Digital Age: Emergence of Electronic Money (E-money)

As the end of the 20th century neared, advancements in the internet and electronic communication fostered the development of electronic money or e-money. Unlike traditional cash, e-money exists solely in digital format, stored electronically.

Centralizing Trade: The Advent of Centralized Currency Exchanges

To cater to the growing trade volumes and diverse currencies, centralized exchanges emerged in key cities worldwide. Serving as hubs where currencies were traded, these exchanges set the groundwork for today’s expansive fx trade market, offering traders a streamlined and secure trading atmosphere.

Learn more: History of Money

The Evolution of the Modern Forex Market

Post-War Reconstruction: Laying the Groundwork for Modern Forex

After World War II, nations grappled with rebuilding and stabilizing their economies, laying the groundwork for the contemporary Forex market.

Bretton Woods Agreement: Stabilizing Global Currencies

The 1944 Bretton Woods Agreement was a watershed moment in global finance. Designed to stabilize international currencies and strengthen economic relations, the agreement pegged many global currencies to the U.S. dollar. The U.S. dollar’s strength, post-war economic dominance, and stability made it a favourable choice to be pegged to gold, acting as a linchpin for other currencies. With the dollar’s peg to gold at $35 an ounce, it solidified its role as the world’s primary reserve currency.

The Collapse of Bretton Woods: Birth of Free-Floating Currencies

By the 1970s, the system showed signs of strain. Mounting U.S. trade deficits and escalating domestic expenses, such as the Vietnam War’s costs, stretched the U.S. gold reserves thin. The situation reached its zenith in 1971 when President Nixon ended the dollar’s gold convertibility, a move termed the “Nixon Shock.” This marked the beginning of an era where currency exchange rates were dictated by global market forces, leading to the dynamic Forex market of today.

Technological Leap: Transforming Forex in the 1990s

As technological advancements continued, the world of Forex trading what it is today underwent another major shift, paving the way for an era of digital renaissance. The 1990s heralded significant changes in Forex trading, driven primarily by technological leaps.

From Phones to Pixels: The Rise of Electronic Trading Systems

The advent of electronic trading systems in the early ’90s revolutionized Forex. With faster transactions, real-time data, and transparent pricing, the days of phone trades and manual documentation were numbered. Forex and trading were firmly entering the digital age.

Internet Accessibility: Forex for All

With growing global internet accessibility, the once-exclusive domain of institutional traders opened up. Forex trading, earlier reserved for financial giants, became accessible to the everyday individual. This shift marked the ascent of the “retail investor.”

Digital Efficiency: Making Forex More Affordable

The digitalization of platforms slashed brokers’ transaction costs. These savings often benefited traders in the form of tighter spreads and lower fees. Paired with the internet’s widening reach, Forex trading became an enticing prospect for many.

The Digital Renaissance in Forex Trading

The onset of the digital age ushered in a wave of tools and platforms, forever altering the Forex trading landscape.

From Analog to Digital: A Revolution in Forex Trading

As technology advanced at an unprecedented pace, groundbreaking digital trading platforms took centre stage. These platforms weren’t just mere enhancements but transformative forces. They equipped traders with powerful analytics, advanced charting tools, and real-time pricing, levelling up their decision-making capabilities.

The Rise of MetaTrader and Its Peers

One platform that notably stood out was MetaTrader. It not only bridged the gap between retail traders and professionals but also democratized access to features previously reserved for elite financial institutions. With customizable indicators and algorithmic trading options, MetaTrader heralded a new era in Forex trading for starters.

Unlocking New Frontiers: The Pinnacle Features of Digital Platforms

What truly set these platforms apart were their innovative capabilities: continuous data streams, intricate technical analysis tools, and the advent of automated trading. This technological leap facilitated around-the-clock trading, often independent of human intervention.

Leveraging VPS in the Dynamic World of Forex Trading

In the frenetic realm of Forex where milliseconds often dictate profit margins, traders are perpetually on the lookout for ways to refine their strategies. One such tool that has swiftly become indispensable is the Virtual Private Server (VPS). In this discussion, we’ll uncover the pivotal role VPS plays in ensuring minimal latency, enabling continuous trading, and delivering unparalleled reliability.

Decoding VPS: Its Integral Role in Forex Trading

A Virtual Private Server (VPS) can be visualized as a dedicated server’s emulation within a larger hosting environment. It permits users to run several virtual server instances on a singular physical server. In the world of Forex, where prompt order processing is paramount, hosting a fx trading platform on a VPS brings it closer to the broker’s server. This proximity drastically diminishes latency, ensuring timely trades.

Empowering Trading Bots with VPS

The ascendancy of automated trading has brought bots to the forefront as indispensable allies for traders. For these bots to consistently deliver peak performance, they require an unwavering internet connection and a disruption-free environment. VPS rises to this occasion, offering the essential stability that ensures bots run seamlessly around the clock.

VPS’s Evolution: Anticipating the Next Wave of Advancements

As we gaze into the future of trading Forex, it’s evident that advanced VPS solutions will carve the path. Given the escalating demand for speed, unwavering reliability, and iron-clad security, it’s anticipated that forex VPS providers will innovate systems to further fine-tune order execution and bolster worldwide connectivity.

Current and Emerging Technological Trends in Forex

Forex trading, once characterized by manual computations and intuitive decision-making, is currently undergoing a monumental transformation, propelled by technological advancements. The integration of Artificial Intelligence (AI) and Machine Learning (ML), paired with the pervasive nature of mobile trading platforms, heralds a new era in this domain. This exploration will navigate the present innovations and forecast the exhilarating possibilities that lie ahead.

AI and ML: Elevating Predictive Analysis

Far from being mere technological jargon, Artificial Intelligence (AI) and Machine Learning (ML) have cemented their roles as catalysts for change across various sectors, with Forex trading being a prime beneficiary. The sheer processing power of AI, coupled with ML’s adaptability, is revolutionizing predictive analytics in Forex.

Empowered by these tools, traders can now shift through vast data streams in real-time – from geopolitical nuances to subtle market mood swings. As these algorithms become increasingly refined, they offer more precise predictions, ushering in insights once considered beyond reach.

Mobile Trading: Decentralizing Forex Access

In our digitized era, where mobile connectivity is king, Fx trade platforms have evolved to embrace this change. Mobile trading apps have democratized access to Forex, granting seasoned traders and novices alike the ability to engage with markets, execute trades, and manage portfolios on the go.

Gone are the days when trading was an office-bound activity. Now, irrespective of your geographical location or time zone, the global markets are accessible with just a tap, ensuring traders are always in sync with market dynamics.

Peering into Tomorrow: The Allure of Quantum Computing and Blockchain

While current advancements are riveting, the future appears even more promising. Quantum computing, with its capability to perform complex calculations at unfathomable speeds, could redefine algorithmic trading. These computers, capable of processing vast amounts of data in parallel, could offer real-time market insights, enabling traders to react instantaneously to market shifts.

Furthermore, the underpinnings of cryptocurrencies, blockchain technology, hold substantial promise for Forex. Beyond fueling the rise of digital currencies as tradable assets, blockchain’s inherent transparency and security could revolutionize trading platforms, making them more resilient and transparent.

Emerging technologies, such as augmented and virtual reality, might also find their footing in the Forex realm, offering traders immersive experiences or novel approaches to visualizing market data.

Conclusion

From its ancient roots to its modern digital transformation, the Forex market stands as a testament to human innovation and adaptability. As we stand on the brink of the quantum computing and blockchain revolutions, the evolution of Forex remains relentless. Its storied past paints a narrative of continual change, and its horizon brims with untapped potential. For those navigating this domain, staying informed and agile is not just an advantage—it’s a necessity. As Forex continues its dynamic journey, the opportunities it unfurls are boundless. Traders must remain vigilant and adaptive, embracing both the technological innovations and the challenges they bring. As the future unfolds, those best equipped with knowledge and adaptability will find the greatest success in the ever-evolving world of Forex.

Seeking seamless trading during pivotal moments? Fast Forex VPS delivers high-speed, Forex-focused connectivity just for you.

Elevate your trades with unmatched speed today!